In our first article we discussed the different ways businesses can be valued. Here we consider sectors and how two businesses with seemingly similar capacity, asset value and profitability can attract significantly different valuations.

The quick and easy answer is risk. For example, valuations of companies in the construction industry are often soft, and the sector’s troubles in recent years are well documented. Conversely, technology is a sector where valuations are booming, so much so that many of the so-called unicorns (valued at >£1bn) are yet to turn a profit. Facebook’s ability to move from a similar position to posting an almost $16bn profit last year might go some way to explaining how and why investors continue to accept this. Spotify was valued as high as $30bn on it’s listing debut last week.

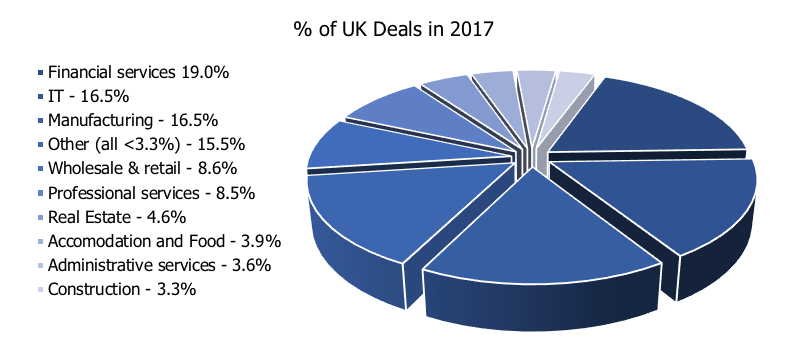

According to data extracted from Experian, in the 2017 calendar year financial services was the most active sector for deals involving UK-based target companies, followed closely by IT and manufacturing. Behind these, the only sectors achieving more than 5% of deals were professional services and wholesale & retail.

Within each of these broad sectors there are a plethora of sub-sectors, each at a different stage within their industry life cycle. It is this position within the life cycle that will determine the quantity, value and type of transactions that will occur. For example, if only growth capital and minority stake transactions are considered, IT and Financial Services jump to 21.6% and 35.4% of all UK deals, suggesting they were the highest growth sectors in the year for investment.

When looking purely at acquisition and merger transactions, the most active sector was Manufacturing (16.5%) suggesting that the subsectors within this are aggregately further along the industry life cycle. IT (14.1%) came in second while Professional Services (11.6%) and Wholesale & Retail (11.2%) also ranked highly in the category. A higher ranking in this category would suggest that the sector is more mature and consolidating. IT’s high ranking in each category demonstrates its changing landscape.

If you have any queries or need advice, EMC’s valuation team are available to discuss with you on a strictly confidential basis. Call us on 01273 945984.