EMC’s Annual Corporate Finance Review

EMC’s annual South East Corporate Finance review including disposals, acquisitions, mergers and finance news updates

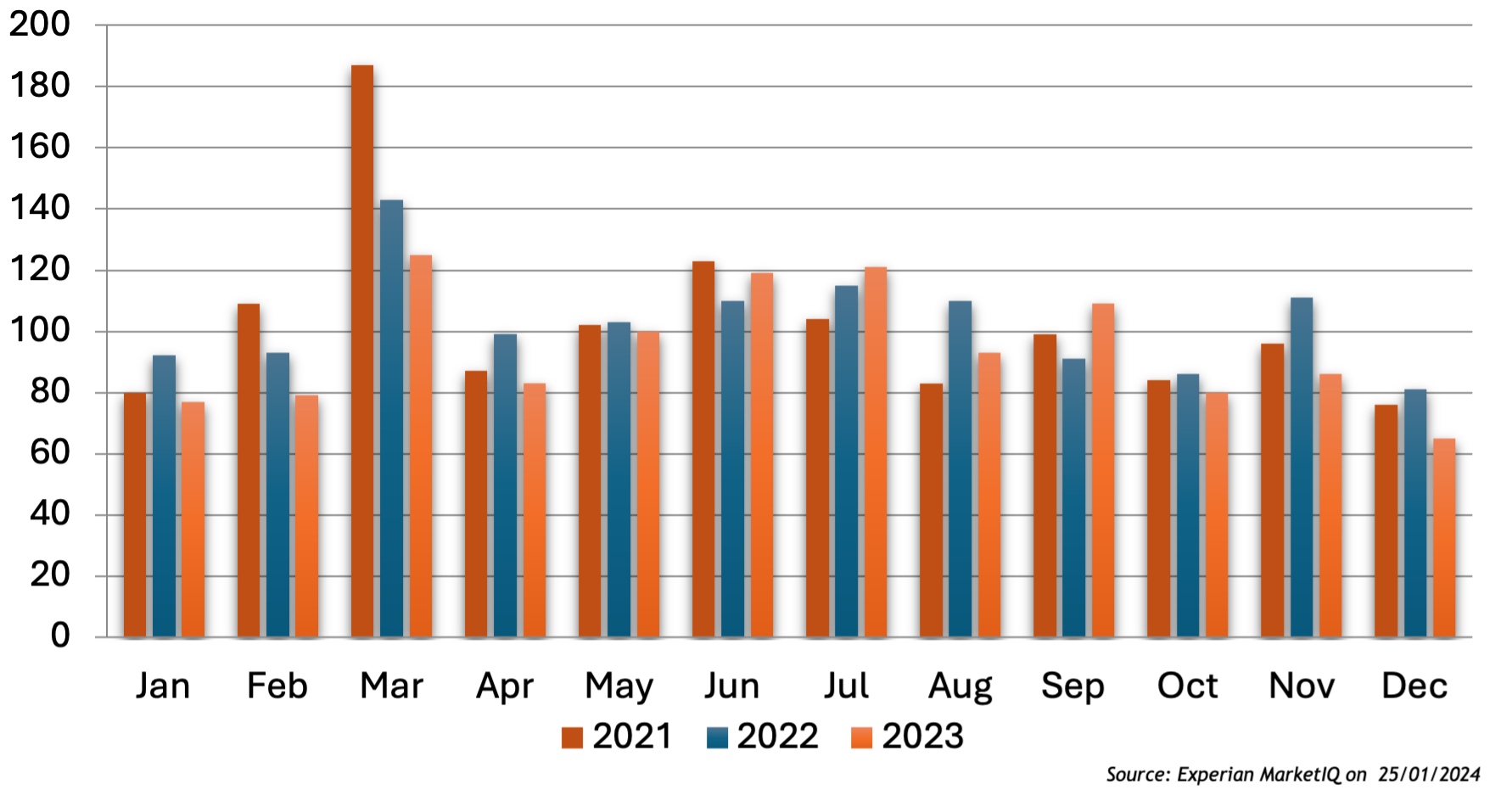

Welcome to our annual corporate finance review for 2023. The UK M&A market has been broadly stable despite the macro-economic challenges faced throughout the year. According to data derived from Experian, at the time of publication, 1,130 deals in the South East were reported in 2023 which represents an 8.4% decline compared to the 2022 figures. To put this into wider context the volume of deals in 2023 still exceeds the numbers seen in 2020 and 2019. The South East has remained a key place in the UK for deals ranking as the busiest outside London across the year.

Following record fundraising in the previous year, 2023 looked set for a bumper year for Private Equity (PE) transactions and investments but the global pressures have squeezed the sector. PE deals accounted for just 26% of overall UK deals compared to 59% in the preceding year and were therefore a key component in the falling deal volumes. Despite not completing as many deals, PE continued to play a key role in most deal processes. At EMC our 2023 deals list included the sales of Falanx Cyber Security and Incorpore to PE backed trade buyers.

With the PE sector still sitting on significant dry powder, optimism remains for a busy year in 2024 which would be greatly aided by reductions across interest rates and inflation. Current expectations are that interest rates will fall throughout the year along with inflation with energy prices following swiftly behind.

Deal highlights in the South East include:

- The acquisition of specialist schemes broker Darwin Clayton by private equity-backed The Jensten Group

- The international acquisition of Vermont-based developer of wireless sensing systems MicroStrain by Egham-headquartered Spectris for £29.4m, and

- The merger of South East based legal firms Cripps and PDT Solicitors

2024 looks set to be an election year for both the UK and US with the current polls forecasting changes in government in both locations. Keir Starmer, the Labour Party leader has expressed the intention to tighten the trade relationship with the European Union, aiming to advance market access and promote expansion leading to a rise in Britain’s productivity growth, placing wealth creation as a “number one priority”. The M&A market will need to contest with political and macro uncertainty, but opportunities remain which we discussed last month.